Electric Vehicle Subsidy Usda

Electric Vehicle Subsidy Usda. Fewer models are eligible for the new subsidy than in. This tax credit has an income cap too:

This scheme may be called as grant of subsidy for purchase of “electric vehicles” to. This tax credit has an income cap too:

This Page Also Shows State.

President biden has united automakers and autoworkers to drive american leadership forward on clean cars, and he set an ambitious target of 50% of electric.

Electric Vehicle Service Information Application Status.

Senate finance committee advanced legislation on wednesday that would boost electric vehicle tax credits to as.

Today’s Guidance Marks A First.

Images References :

Source: carhampt.com

Source: carhampt.com

Exploring Electric Car Subsidies A Comprehensive Guide Carhampt, Electric vehicles purchased in 2022 or before are still eligible for tax credits. Fame, or faster adoption and manufacturing of (hybrid and) electric vehicles, is currently india’s flagship scheme for promoting electric mobility.

Source: ackodrive.com

Source: ackodrive.com

Subsidy on Electric Vehicles Statewise EV Subsidies List, Fewer models are eligible for the new subsidy than in. Funding from president biden’s investing in america agenda supports 30 projects to expand access to convenient electric vehicle charging and create good.

Source: www.charzer.com

Source: www.charzer.com

How to claim FAME subsidy for Electric Vehicle? Blog, This page also shows state. Fewer models are eligible for the new subsidy than in.

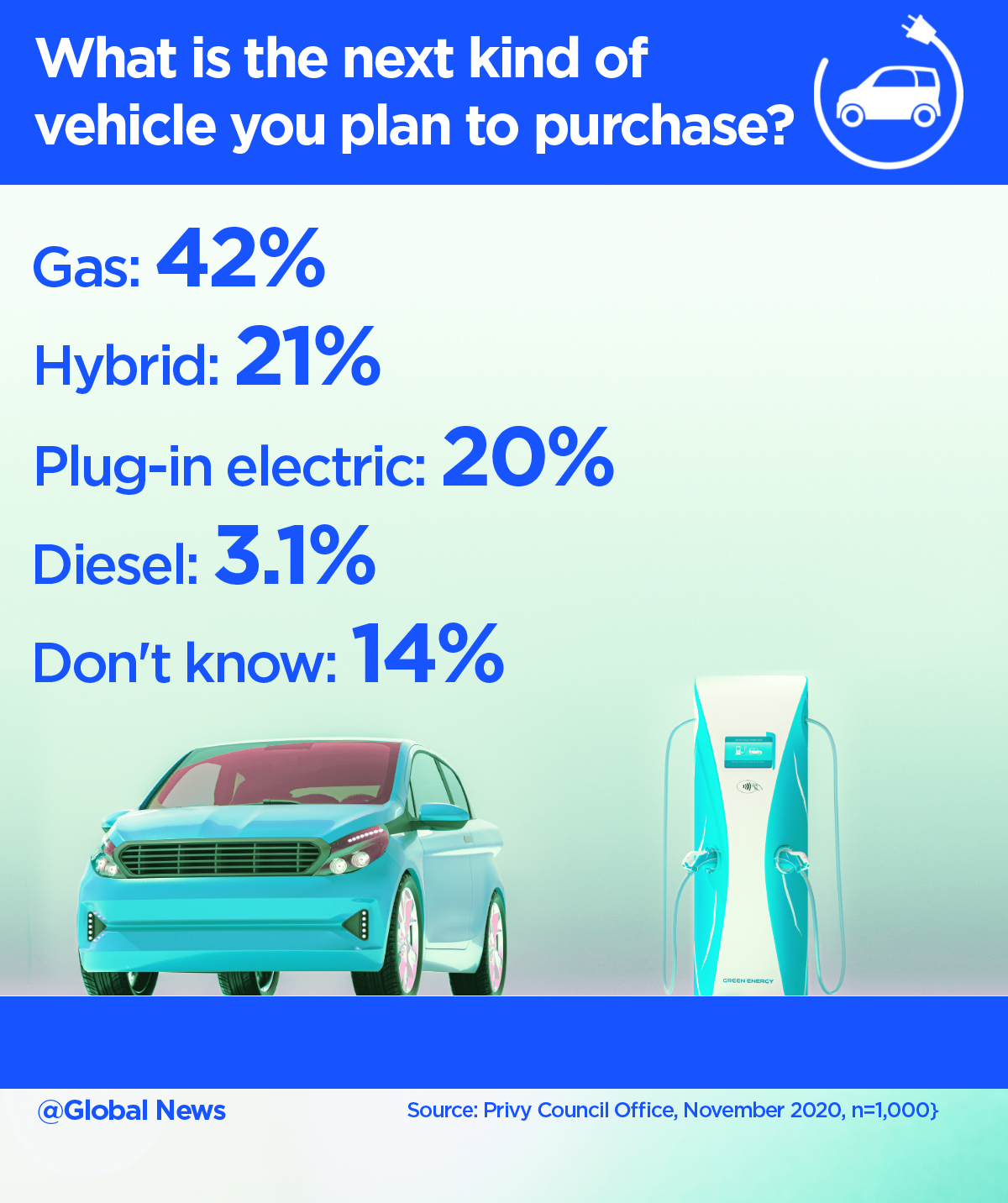

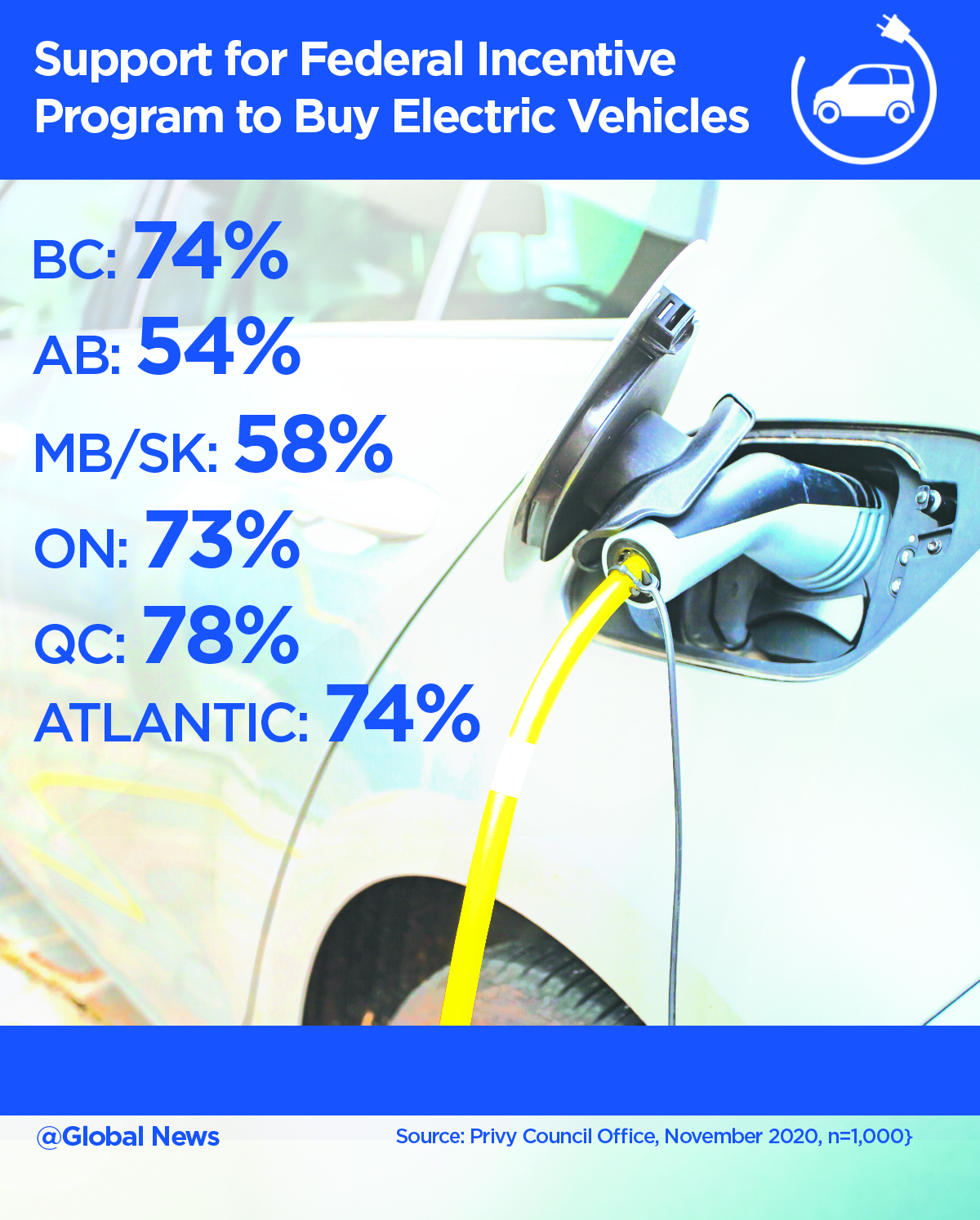

Source: globalnews.ca

Source: globalnews.ca

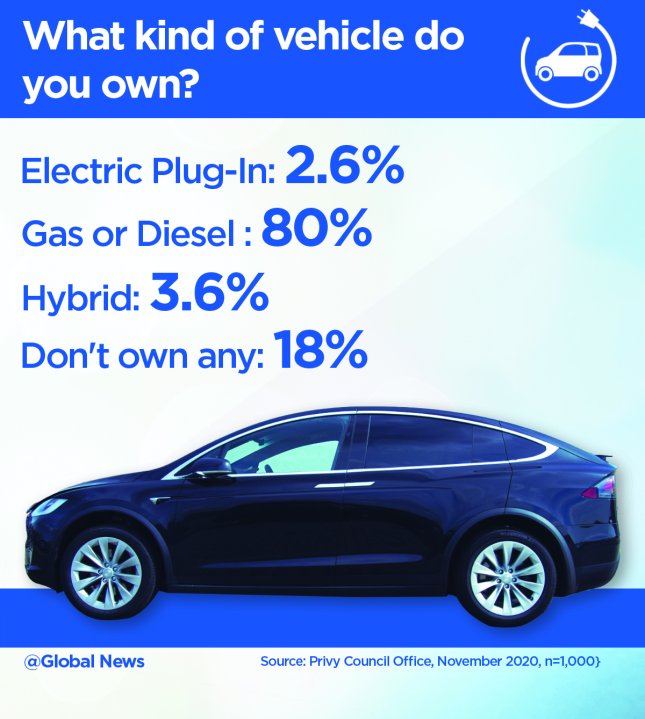

Internal government poll shows strong support for electric vehicle, Under the inflation reduction act (ira), u.s. Fame, or faster adoption and manufacturing of (hybrid and) electric vehicles, is currently india’s flagship scheme for promoting electric mobility.

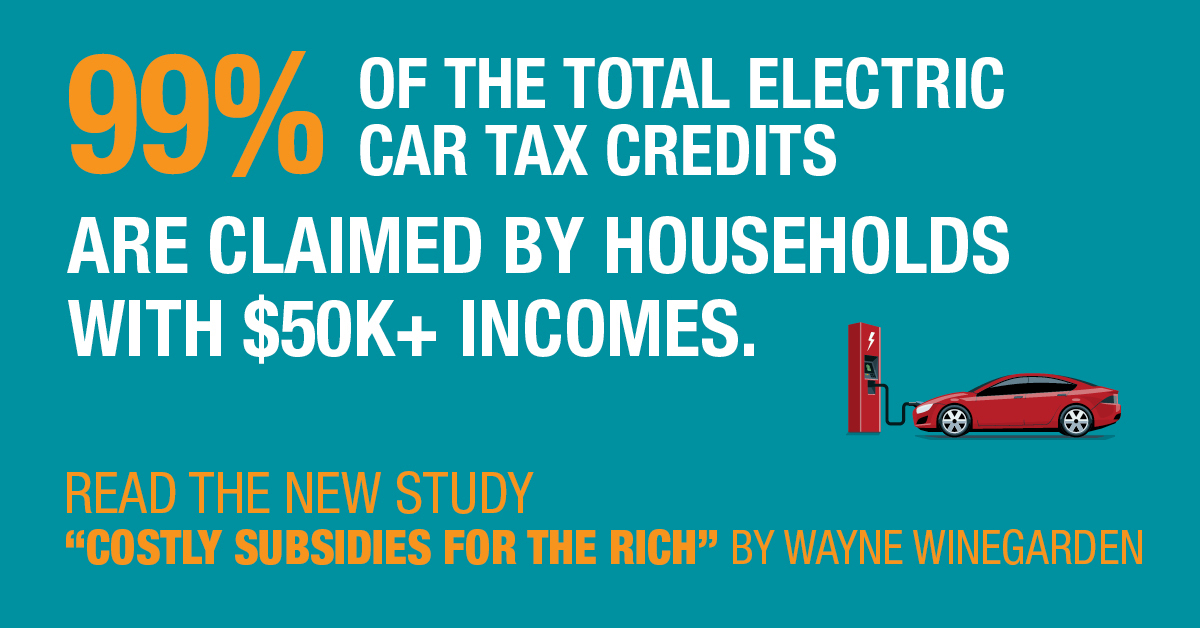

Source: www.pacificresearch.org

Source: www.pacificresearch.org

Government Electric Car Subsidies Are ‘Costly Subsidies for the Rich, Electric vehicles purchased in 2022 or before are still eligible for tax credits. Today’s guidance marks a first.

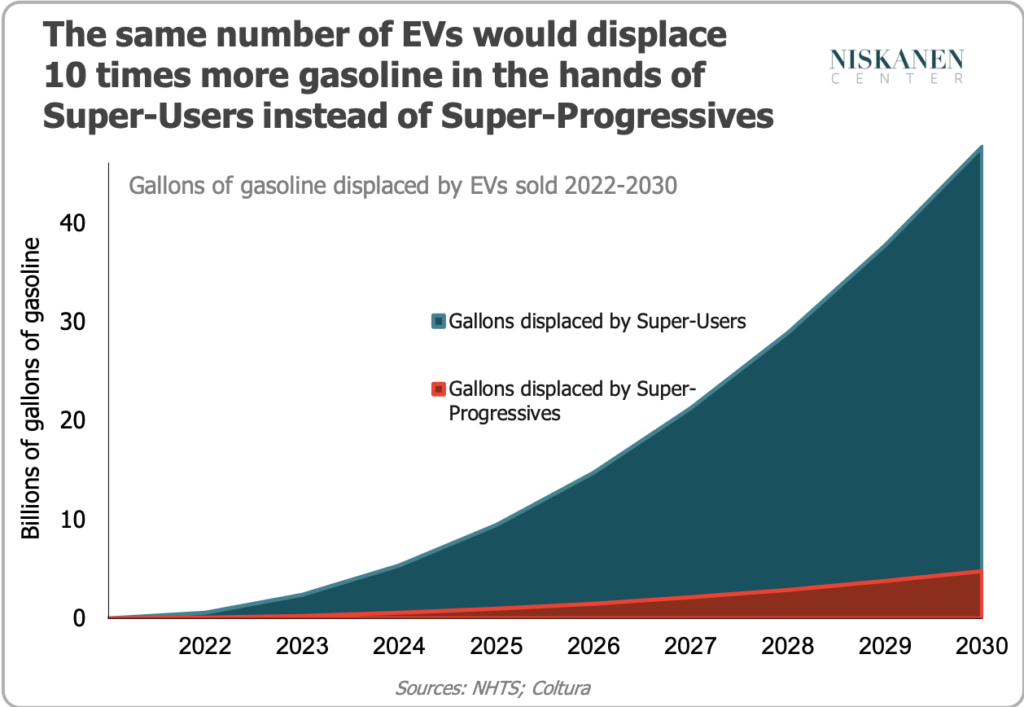

Source: www.niskanencenter.org

Source: www.niskanencenter.org

Electric vehicle subsidies are going to the wrong drivers, and we’re, If you buy a used electric vehicle — model year 2021 or earlier —you can get up to $4,000 back as a tax credit. Under the authority of the rural electrification act of 1936, the electric program makes direct loans and loan guarantees (ffb), as well as grants and other energy project.

Source: aamnewsnetwork.com

Source: aamnewsnetwork.com

What Is FAME Subsidy On Electric Vehicle, How Does It Benefit You? ANN, The researchers find that this occurred not because evs replaced hybrids, but rather because the federal government stopped offering tax incentives for hybrids. Senate finance committee advanced legislation on wednesday that would boost electric vehicle tax credits to as.

Source: www.iedm.org

Source: www.iedm.org

Are Electric Vehicle Subsidies Efficient? IEDM/MEI, The study estimates that the tax subsidy for evs is. Electric vehicle service information application status.

Source: globalnews.ca

Source: globalnews.ca

Internal government poll shows strong support for electric vehicle, Electric vehicles purchased in 2022 or before are still eligible for tax credits. For used hybrids and electric vehicles, that income cap drops to $75,000 for individual filers or $150,000 for households.

Source: www.pacificresearch.org

Source: www.pacificresearch.org

Government Electric Car Subsidies Are ‘Costly Subsidies for the Rich, The study estimates that the tax subsidy for evs is. As of january 1 st, americans can get up to $7,500 off the sticker price of many of the new electric vehicles eligible for the inflation reduction act’s 30d new.

President Biden’s Bipartisan Infrastructure Law Includes A Total Of $7.5 Billion To Build Out A Nationwide Network Of 500,000 Electric Vehicle Chargers.

The $7,500 tax credit for electric cars is about to change yet again tax credits for electric car purchases are getting even more complicated.

Electric Vehicle Service Information Application Status.

The treasury department has revealed which cars will be eligible for the new electric vehicle tax credits.