Illinois Tax Credits For Electric Vehicles

Illinois Tax Credits For Electric Vehicles. Published january 7, 2023 at 4:00 am cst. Does illinois have tax credits for buying used evs?

Illinois will offer significant benefits to electric vehicle and battery manufacturers locating in the state under tax incentive legislation approved tuesday by. In november 2021, illinois governor jb pritzker signed the reimagining electric vehicles act (the rev act), which, together with the recently.

Georgia Will Give You Tax Credit To Convert Your Vehicle Electric.

We want to have a million electric vehicles on the road by 2030, and we are attacking that from all ends,” mitchell says.

In Round One, 921 Rebates Were Granted.

The big climate and health care bill signed into law by president biden has what at first sight looks like a big incentive for those shopping for a car:

The Illinois Department Of Commerce And Economic Opportunity‘s Reimagining Electric Vehicles In Illinois Program (Rev Illinois Program) Offers Tax.

Images References :

Source: abc7chicago.com

Source: abc7chicago.com

Illinois tax rebates for solar panels, electric cars and chargers save, An estimated $9.7 million will be available for. We want to have a million electric vehicles on the road by 2030, and we are attacking that from all ends,” mitchell says.

Source: oakwoodelectric.com

Source: oakwoodelectric.com

2023 EV Charger Federal Tax Credit Oakwood Electric & Generator, Illinois overhauled its tax incentive program aimed at electric vehicle manufacturers under a bill signed wednesday by gov. Illinois offers a $4,000 electric vehicle rebate instead of a tax.

Electric Vehicles Illinois Tax Credit For Electric Vehicles, Georgia will give you tax credit to convert your vehicle electric. A law extends tax credits for people who buy electric vehicles and also tax credits that encourage building more vehicles in the united states.

Source: electricvehiclesmedzukibu.blogspot.com

Source: electricvehiclesmedzukibu.blogspot.com

Electric Vehicles Illinois Tax Credit For Electric Vehicles, The $7,500 tax credit is actually two separate credits, worth $3,750 each. A law extends tax credits for people who buy electric vehicles and also tax credits that encourage building more vehicles in the united states.

Source: www.signnow.com

Source: www.signnow.com

Illinois 1040 20172024 Form Fill Out and Sign Printable PDF Template, It will be easier to get because it will be available as an instant rebate at. In round one, 921 rebates were granted.

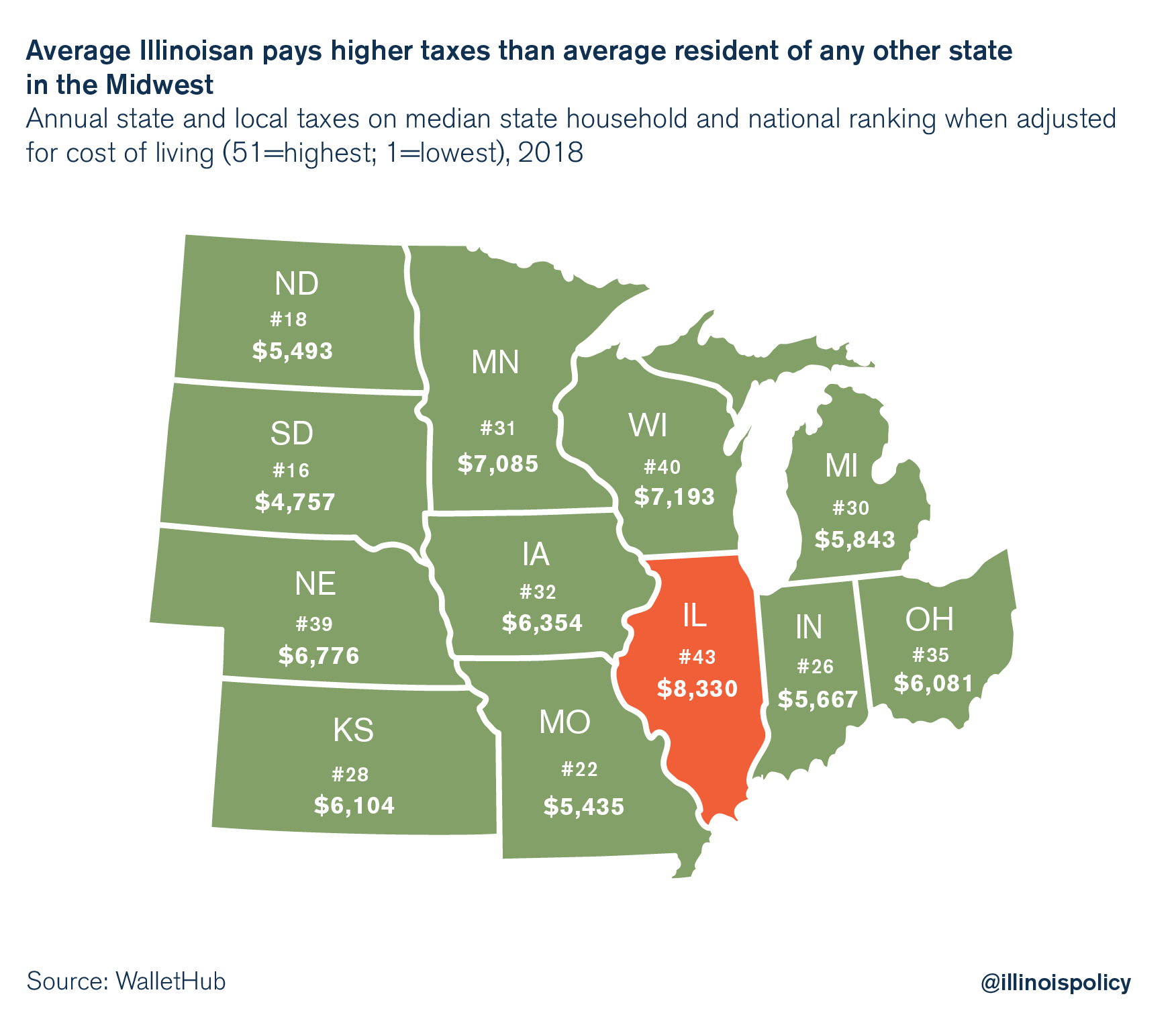

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Illinois imposing car tradein tax on Jan. 1; Dealers call it double, The $7,500 tax credit is actually two separate credits, worth $3,750 each. A law extends tax credits for people who buy electric vehicles and also tax credits that encourage building more vehicles in the united states.

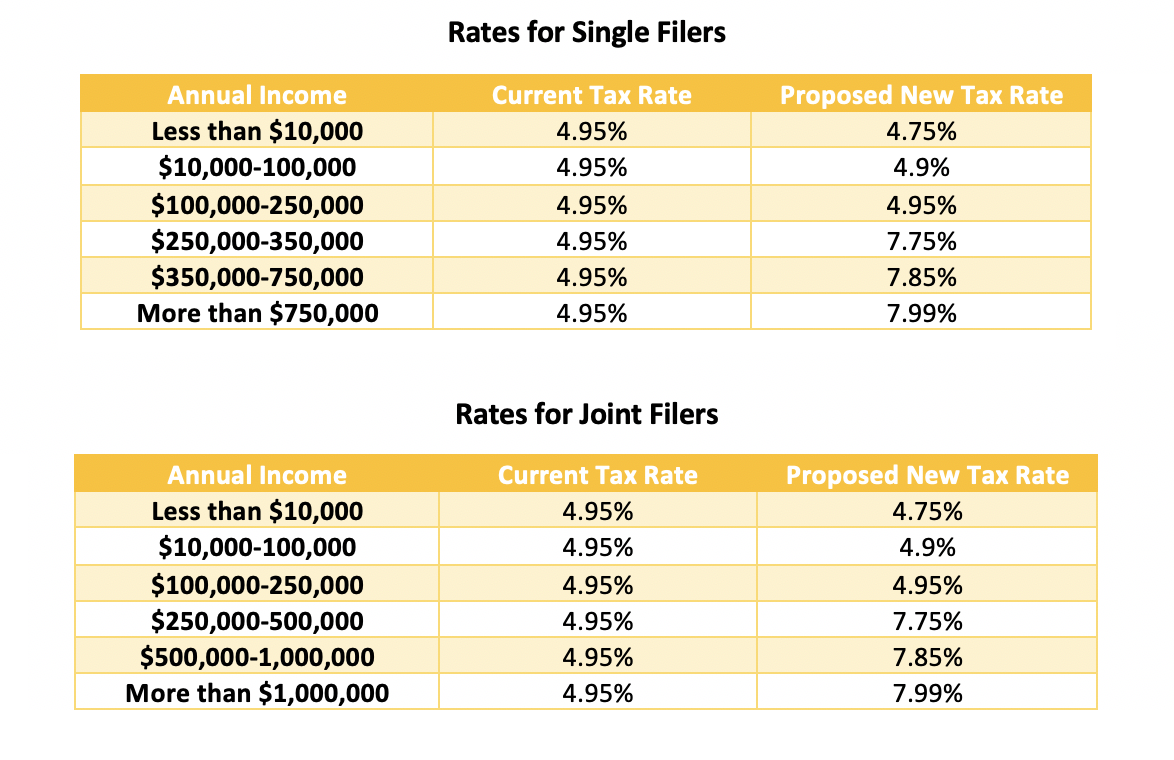

Source: w4formsprintable.com

Source: w4formsprintable.com

IL State Tax Withholding 2021 2022 W4 Form, Illinois offers a $4,000 electric vehicle rebate instead of a tax. Here's what you need to know about price caps, income limits and other rules.

Source: www.illinoispolicy.org

Source: www.illinoispolicy.org

Study Illinois home to highest overall tax burden in the nation, Illinois offers a $4,000 electric vehicle rebate instead of a tax. In november 2021, illinois governor jb pritzker signed the reimagining electric vehicles act (the rev act), which, together with the recently.

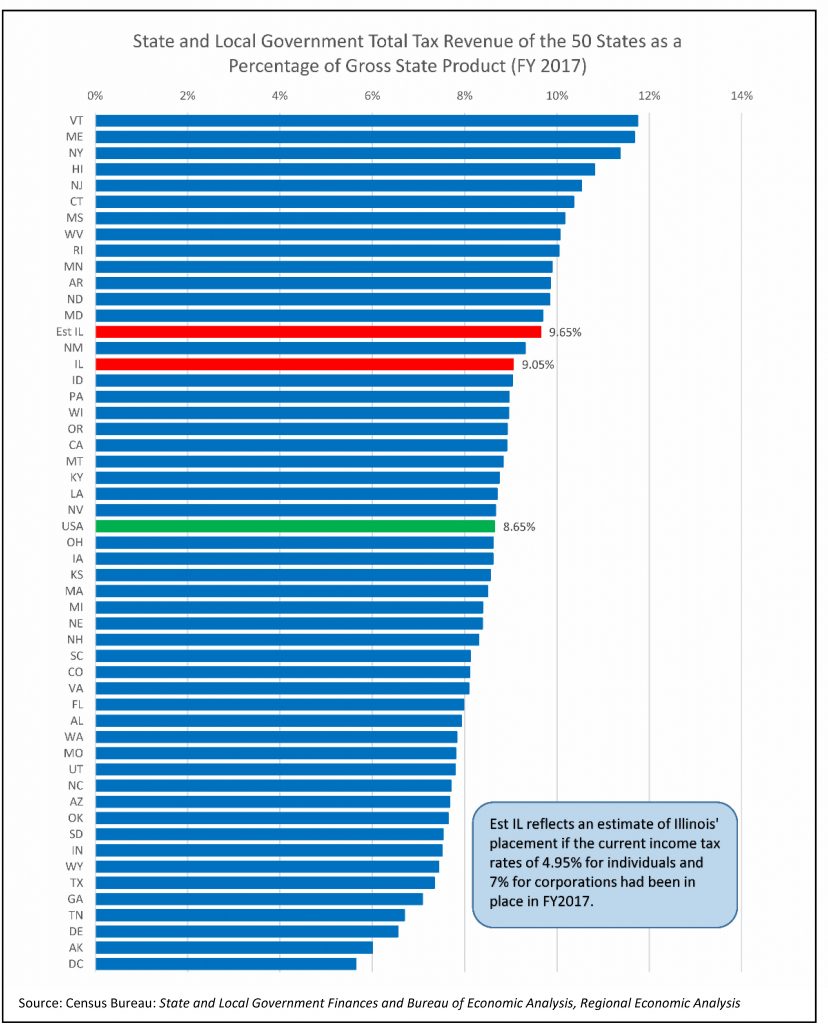

Source: www.illinoistax.org

Source: www.illinoistax.org

Taxpayers' Federation of Illinois Tax Facts An Illinois Chartbook, Georgia will give you tax credit to convert your vehicle electric. The state rebate can be combined with the federal clean vehicle rebate, which took effect on august 16, 2022.

Source: www.bellpolicy.org

Source: www.bellpolicy.org

Cut Taxes, Raise Revenue Can Illinois' Tax Plan Work for Colorado?, Published january 7, 2023 at 4:00 am cst. Illinois will offer significant benefits to electric vehicle and battery manufacturers locating in the state under tax incentive legislation approved tuesday by.

A Lot Of People May Be Thinking About Buying An Electric Car This Year.

Illinois offers the following incentives for electric vehicle charging, maintenance, or related benefits:

For The First Time In Years, Some Teslas Will Qualify For A $7,500 Federal Tax Credit For New Electric.

It will be easier to get because it will be available as an instant rebate at.